Overview

The Montag & Caldwell Mid Cap Growth strategy extends the Firm’s capabilities into the mid cap asset class while leveraging the strength of the Firm’s resources and its successful, time-tested, fundamentally driven investment process.

The Montag & Caldwell Mid Cap Growth strategy extends the Firm’s capabilities into the mid cap asset class while leveraging the strength of the Firm’s resources and its successful, time-tested, fundamentally driven investment process.

Philosophy and Process

The mid cap growth strategy extends our equity capabilities into the mid cap asset class while leveraging the strength of our resources and our time-tested, fundamentally driven investment process. As with large cap, the mid cap equity selection process is a growth approach focusing on high quality companies. It employs the same bottom-up process in which we interrelate valuation with earnings momentum, but focuses on identifying investment candidates within the range of market capitalizations of companies encompassing the 201st largest company traded on U.S. stock exchanges and the 1000th. Our objective is to identify high quality, mid cap growth stocks that are selling at a discount to intrinsic value and are expected to exhibit above-median near-term relative earnings strength.

The Mid Cap Growth stock selection process is complemented by a risk-adverse approach that employs both balanced diversification and a strict sell discipline.

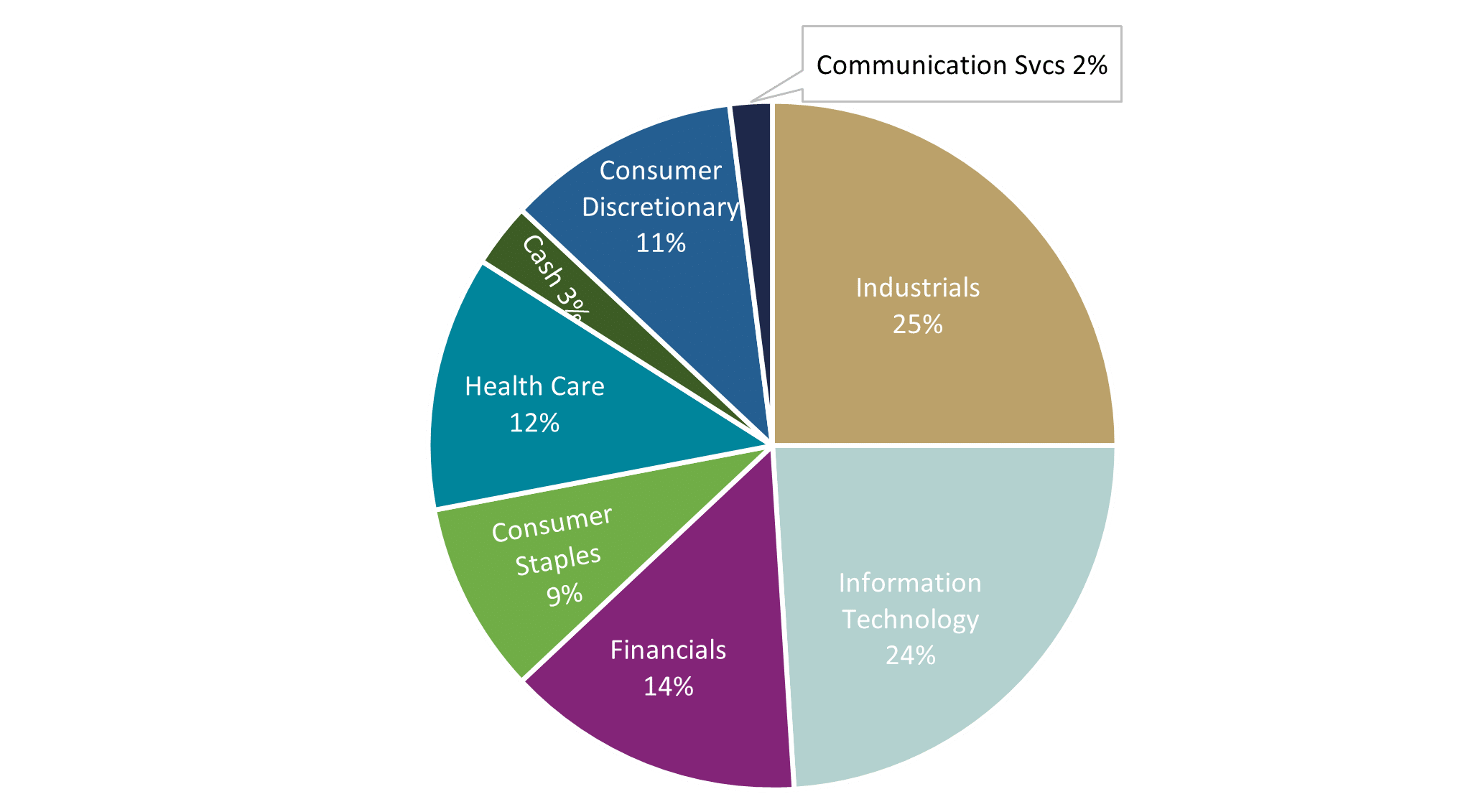

Sector Weights

September 30, 2025

Portfolio sector weights are of the Montag & Caldwell Mid Cap Growth Representative Account. Please see the disclosures presentation at the bottom of this page for important information that is pertinent to this chart. Source: FactSet

Vehicles

Separate Accounts

The Mid Cap Growth strategy is offered through separate account mandates which we introduced in April 2007. This product leverages our firm’s investment process and discipline in the mid cap area. Many of these names are currently being covered for our Large Cap Growth strategy and therefore this work does not compromise the integrity of that strategy in any way.

Portfolio Detail

As of September 30, 2025

Portfolio characteristics and top ten equity holdings are of the Montag & Caldwell Mid Cap Growth Representative Account. Please see disclosure presentation at the bottom of this page for important information that is pertinent to these tables.

Characteristics

Source: FactSet

| Number of Holdings | 29 |

| P/E - Next 12 months | 19.94 |

| 5 Yr. Average ROE | 13.03 |

| LT Debt to Capital | 26.34 |

| Est 3-5 Yr EPS Growth | 12.8 |

| Weighted Avg Market Cap | $42,834MM |

| Median Market Cap | $35,678MM |

| Return on Invested Capital (ROIC) | 9.38 |

| Active Share | 99.16 |

| 12 Months Turnover | 22% |

Top Ten Holdings

Source: Portfolio Accounting System

Top Ten Holdings are a percentage of Equities only. References to specific portfolio securities are not intended as recommendations of those securities and carry no implications about past or future performance. Information about all recommendations made within the past year is available upon request.

| Raymond James Financial | 5.2% |

| Corning Inc | 5.2% |

| Veeva Systems Inc | 4.9% |

| TE Connectivity Ltd | 4.9% |

| Monster Beverage Corp | 4.7% |

| DoorDash Inc | 4.5% |

| Marvell Technology Inc | 4.4% |

| Pinterest Inc Cl A | 4.3% |

| Teradyne Inc | 3.7% |

| Intercontinental Exchange Inc | 3.6% |

Disclosures

The S&P 500 Index is an unmanaged index commonly used as a benchmark to measure U.S. stock market performance and characteristics. The reinvestment of dividends and other distributions is assumed. An investor cannot invest directly in an index.

This information is provided for illustrative purposes only. It should not be considered investment advice or a recommendation to purchase or sell any specific security or invest in a specific strategy nor used as the sole basis for an investment decision. All investments carry a certain amount of risk. There are no guarantees that the strategy will achieve its investment objective, and loss of value on investments is a possibility. Principal risks associated with this strategy include: • Growth Stock Risk – These stocks may be more sensitive to market movements because their prices tend to reflect investors’ future expectations for earnings growth rather than just current profits. • Mid-Capitalization Stock Risk – The stocks of mid-capitalization companies may have greater price volatility, lower trading volume, and less liquidity than the stocks of larger, more established companies. • Sector Risk – To the extent the strategy has substantial holdings within a particular sector, the risks associated with that sector increase. • Foreign Investment Risk – From time to time, the strategy may invest in U.S. registered ADRs and foreign companies listed on U.S. stock exchanges which involve additional risks that may result in greater price volatility. • Liquidity Risk – The strategy may not be able to purchase or dispose of investments at favorable times or prices or may have to sell investments at a loss. • Market Risk—Market prices of investments held by the strategy may fall rapidly or unpredictably due to a variety of factors, including changing economic, political, or market conditions, or other factors including war, natural disasters, or public health issues, or in response to events that affect particular industries or companies.