Overview

Balanced portfolios are composed of stocks and bonds, combining our high quality growth approach to equities with the higher and more stable income of bonds. The appropriate asset mix is determined through consultation with the client concerning the client’s risk tolerance, income needs, and growth objective. We further refine the asset allocation between stocks and bonds around the target mix based on our conclusions about market valuation levels, the economy and investor sentiment and liquidity. Asset allocation reflects our judgment of the relative attractiveness of common stocks to other assets. It is based on a broad overview of economic, political and financial market trends. The equity management of balanced accounts follows our investment discipline for equity-only accounts, focusing on growth companies with strong fundamentals at compelling valuation levels. The fixed income portion of balanced accounts is fully invested at all times with risk managed by changing the maturities and sector emphasis of the portfolio over time.

Philosophy

Montag & Caldwell’s Balanced philosophy combines the disciplines of the Firm’s equity and fixed income capabilities. Asset Allocation is client-directed. The Investment Policy Group generally targets a 60% equity-40% fixed income allocation.

The equity portion of the portfolio is the driving force behind performance, while the fixed income portion is the anchor to windward that mitigates portfolio risk. Emphasis is placed upon positioning along the yield curve and sector weightings. In separately managed accounts, investment policy restrictions are easily accommodated.

Minimal shifts around the client’s strategic target asset allocation are made based upon the Investment Policy Group’s outlook for the equity and fixed income markets. Among the factors considered are the economic environment, financial market valuation, economic and investor liquidity, and investor sentiment. Both short and long-term outlooks are evaluated.

Process

Equity Component

We are long-term investors focusing on high quality growth opportunities. Ours is primarily a bottom-up process in which we interrelate valuation with earnings momentum. We offer a concentrated portfolio of 30-40 issues actively managed by a team comprised of both portfolio managers and analysts. The team is the catalyst in our decision-making. While we recognize the need to diversify a portfolio’s securities and sectors in order to reduce its risk, we believe that, in order to add value, it is also important to have some sector concentration in the portfolio. We are willing to totally exclude a sector from our portfolios if we do not see sufficiently accelerating earnings and/or appropriate valuations.

Our large cap growth equity philosophy utilizes a valuation technique which focuses on a company’s future earnings and dividend growth rates. The process utilizes a present valuation model in which the current price of the stock is related to the risk adjusted present value of the company’s estimated future earnings stream. Our analysts closely follow a select list culled from a universe of publicly traded U.S. securities for market capitalization of at least $3 billion (although we generally favor at least $5 billion market capitalization for investment consideration and typically purchase those with an $8-10 billion or greater market capitalization), an expected 10% earnings growth rate, and a proprietary quality evaluation. We seek to buy growth stocks selling at a discount to fair value and at a time when superior earnings per share growth is visible for the intermediate term. Our employment of a risk-adjusted discount rate is a unique component of our valuation work. This rate is determined by our proprietary financial scoring process which rewards high quality companies. A holding will be reviewed for sale when it reaches our target price, which is normally 120% of the estimated fair value. A significant earnings disappointment will trigger an immediate review of the holding and a decision will be made to buy additional shares or reduce or eliminate the position.

Fixed Income Component

Montag & Caldwell utilizes a total return approach to fixed income portfolio management. Both sector weightings and weighted average duration targets are actively managed according to our outlook. Our objective is to provide an above market return while assuming less credit risk than the market.

Montag & Caldwell employs an active, yet conservative, approach to the management of fixed income portfolios. Portfolios are constructed taking the fixed income benchmark indices, which at the current time includes the ICE BofA US Corporate and Government Index and the ICE BofA 1-10 year US Corporate and Government Index, and Client guidelines into consideration.

The Investment Policy Group, consisting of all portfolio managers and analysts, determines the outlook for the economy and interest rates through an analysis of the business cycle. Fed policy, GDP growth, inflation rate expectations, the unemployment rate, exchange rates, industrial production and capacity utilization are factors influencing the duration decision. The weighted average duration is targeted to be long or short versus the benchmark index in accordance with the economic outlook of the Investment Policy Group. Our duration decisions are implemented within a limit of +/- 20% of the benchmark index. The average duration of our clients’ portfolios is adjusted as our outlook changes, which may be monthly or as infrequently as quarterly. Large percentage moves are avoided, with a typical change of 3%.

Analysis of the yield curve is conducted to implement the duration decision. Various points along the yield curve may be under or overweighted versus the index based upon a relative rich/cheap analysis. The historical shape of the yield curve in the context of the current stage of the business cycle plays a role in this analysis. Montag & Caldwell does not utilize strict barbell/bullet strategies, as a percentage of our portfolios will always be maintained in the middle of the yield curve. However, if a flattening of the yield curve is anticipated, with long rates falling, a barbell strategy will be utilized, to the extent that we will underweight the middle of the curve. Conversely, if a steepening of the yield curve is anticipated, a bullet strategy will be employed.

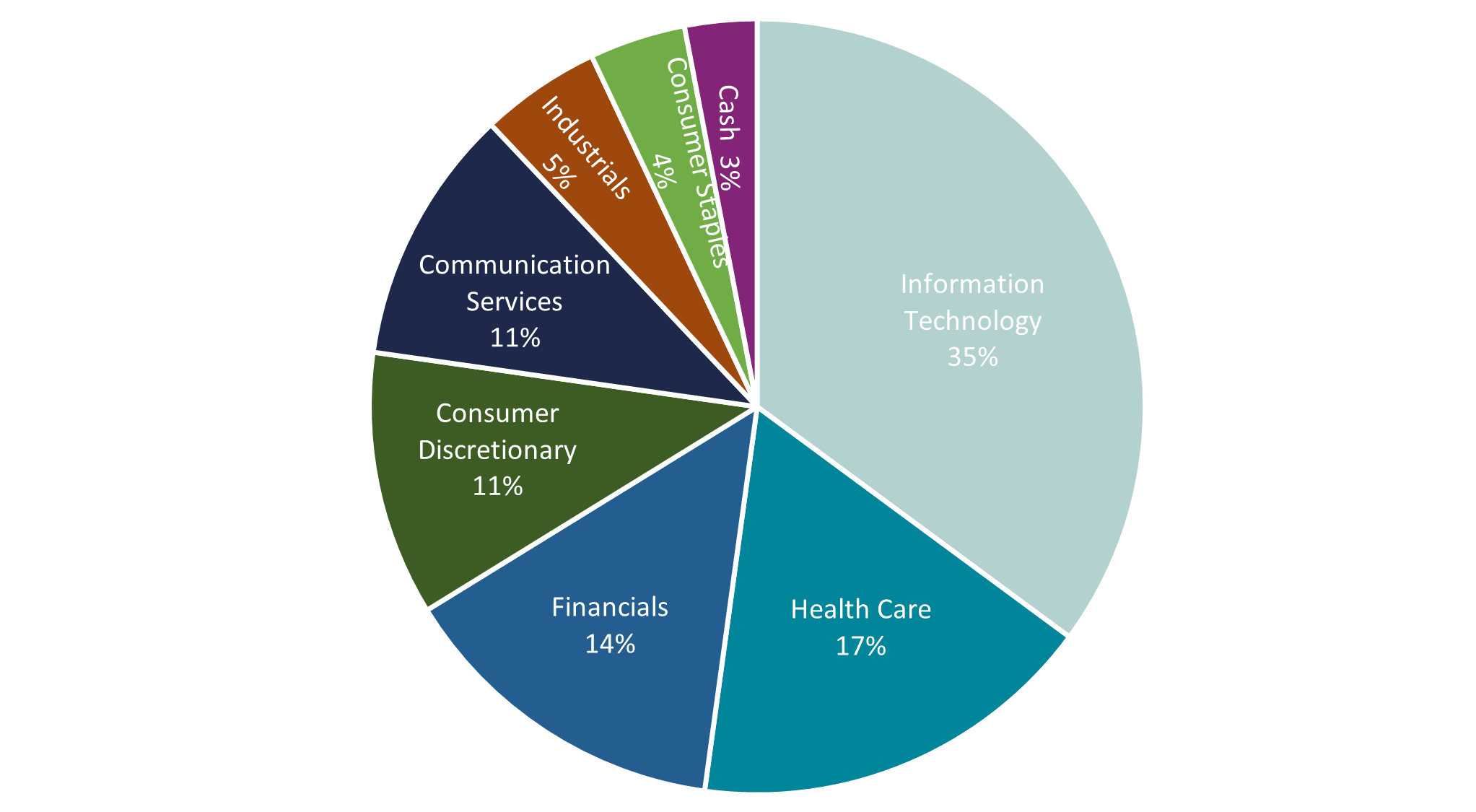

Equity Sector Weights

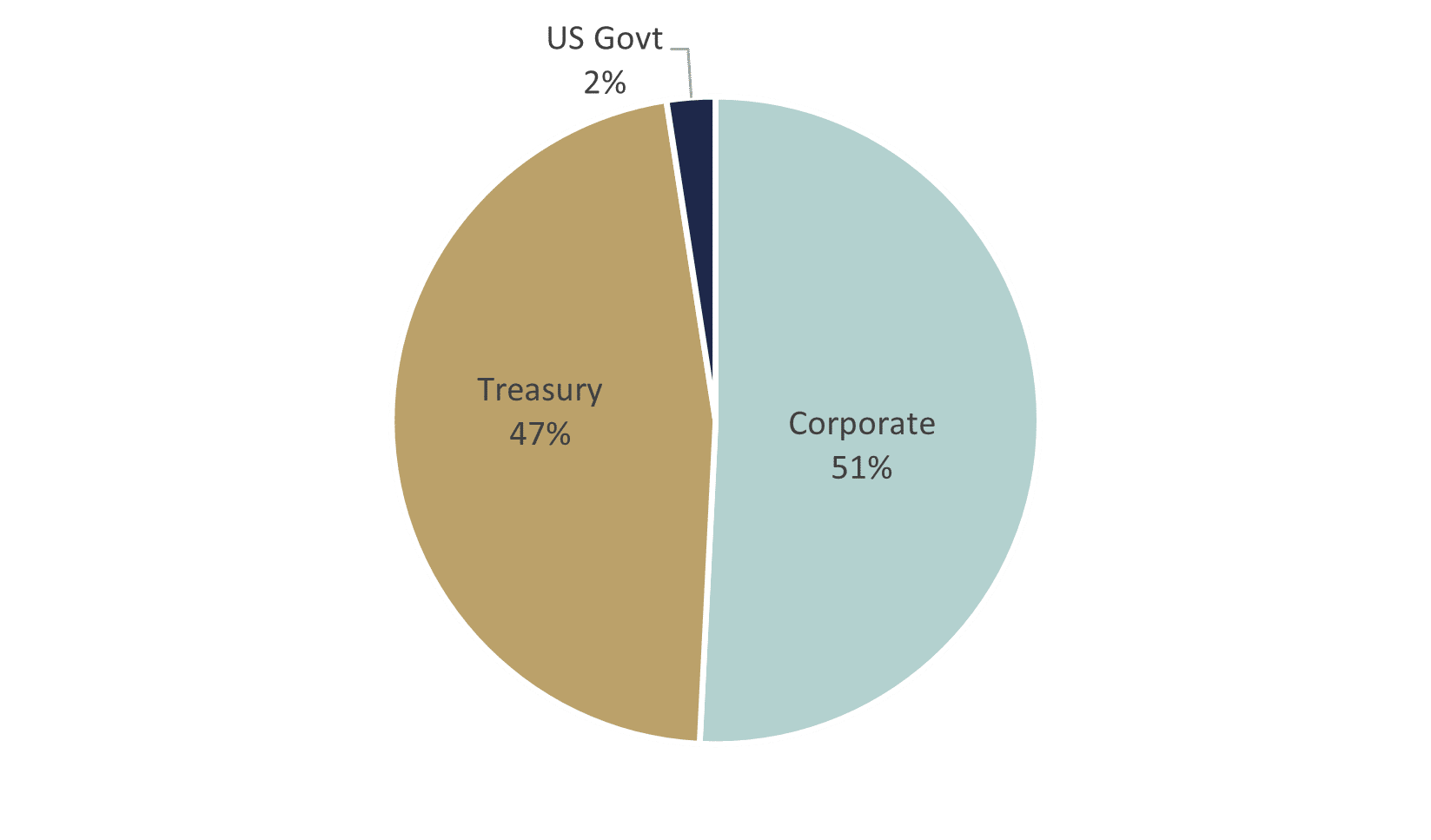

Fixed Income Sector Weights

September 30, 2025

Portfolio sector weights are of the Montag & Caldwell Balanced Representative Account. Please see the disclosures presentation at the bottom of the page for important information that is pertinent to this chart. Source: FactSet

Risk

In the equity allocation, our use of a stock-specific, risk-adjusted discount rate, which is unique, and conservative growth assumptions in our quantitative valuation process have contributed to reducing risk in our portfolios while allowing us to maximize upside potential.

On the fixed income side, we are focused on investment-grade fixed income. Large, liquid issues are primarily purchased for corporates, agencies and asset-backed securities, with a minimum preferred issue size of $500 million. Corporate bonds are typically rated “A” or higher, and asset-backed securities are only “AAA” rated and typically have credit enhancement attached to the issue. Credit risk is avoided on the long end of the yield curve by focusing on corporate bonds with maturities of ten years or less. Excluding U.S. Treasuries, the weighting in an issuer is limited to 5% of the market value of the portfolio.

Equity Characteristics

As of September 30, 2025

Please see the disclosure presentation at the bottom of this page for important information that is pertinent to the below charts. Equity characteristics are of the Montag & Caldwell Large Cap Growth Representative Account. Source: FactSet

| Number of Holdings | 29 |

| P/E - Next 12 months | 27.23 |

| 5 Yr. Average ROE | 27.14 |

| LT Debt to Capital | 30.15 |

| Est 3-5 Yr EPS Growth | 12.6 |

| Weighted Avg Market Cap | $969,985 MM |

| Median Market Cap | $173,225 MM |

| Return on Invested Capital (ROIC) | 26.18 |

| Active Share | 74.83 |

| Turnover (12 months) | 25% |

Fixed Income Characteristics

As of September 30, 2025

Please see the disclosure presentation at the bottom of this page for important information that is pertinent to the below charts. Fixed Income characteristics represent the Montag & Caldwell Balanced Representative Account. Source: Factset

| Average YTM | 3.98 |

| Average Coupon | 3.16 |

| Average Maturity | 4.23 |

| Average Quality | A+ |

| Current Yield | 3.21 |

| Effective Duration | 3.7 |

Top Ten Equity Holdings

As of September 30, 2025

Please see the disclosure presentation at the bottom of this page for important information that is pertinent to the below charts. Equity holdings are of the Montag & Caldwell Large Cap Growth Representative Account and are a percentage of Equities only. References to specific portfolio securities are not intended as recommendations of those securities and carry no implications about past or future performance. Information about all recommendations made within the past year is available upon request. Source: Portfolio Accounting System

| Alphabet Inc Class A | 6.3% |

| Amazon com Inc | 5.1% |

| NVIDIA Corp | 4.8% |

| ASML Holding NV | 4.7% |

| Microsoft Corp | 4.6% |

| Eli Lilly and Company | 4.4% |

| Visa Inc | 4.3% |

| Abbott Laboratories | 4.3% |

| Charles Schwab Corp | 4.1% |

| Intuit Inc | 4.1% |

Disclosures

This information is provided for illustrative purposes only. It should not be considered investment advice or a recommendation to purchase or sell any specific security or invest in a specific strategy nor used as the sole basis for an investment decision. All investments carry a certain amount of risk. There are no guarantees that the strategy will achieve its investment objective, and loss of value on investments is a possibility. Principal risks associated with this strategy include: • Growth Stock Risk – These stocks may be more sensitive to market movements because their prices tend to reflect investors’ future expectations for earnings growth rather than just current profits. • Sector Risk – To the extent the strategy has substantial holdings within a particular sector, the risks associated with that sector increase. • Foreign Investment Risk – From time to time, the strategy may invest in U.S. registered ADRs and foreign companies listed on U.S. stock exchanges which involve additional risks that may result in greater price volatility. • Interest Rate/Prepayment Risk— In periods of rising interest rates, fixed coupon payments on bonds may become less competitive with the market, causing bond prices to decline. In periods of decreasing interest rates, bond issuers may pay back bonds earlier than expected or required, and the strategy may not be able to replace those bonds with similar fixed coupon payments without paying higher prices. • Credit Risk—Bond issuers may be unable or unwilling, or may be perceived as unable or unwilling, to make timely interest or principal payments or otherwise honor their obligations. • Liquidity Risk – The strategy may not be able to purchase or dispose of investments at favorable times or prices or may have to sell investments at a loss. • Market Risk—Market prices of investments held by the strategy may fall rapidly or unpredictably due to a variety of factors, including changing economic, political, or market conditions, or other factors including war, natural disasters, or public health issues, or in response to events that affect particular industries or companies.