January 12, 2024

Market Summary

Will they? Or won’t they? That is the key economic debate for 2024. Will the Federal Reserve successfully deliver the much-hoped-for “soft landing,” one where inflation returns to target without causing a recession? The consensus seems to be that they will, and so far the evidence is on their side. However, we think the jury is still out. We continue to believe that the full effects of the Fed’s tightening campaign, the most aggressive in 40 years, has yet to land. This question will have crucial implications for corporate profits, and therefore stock returns, in the coming year.

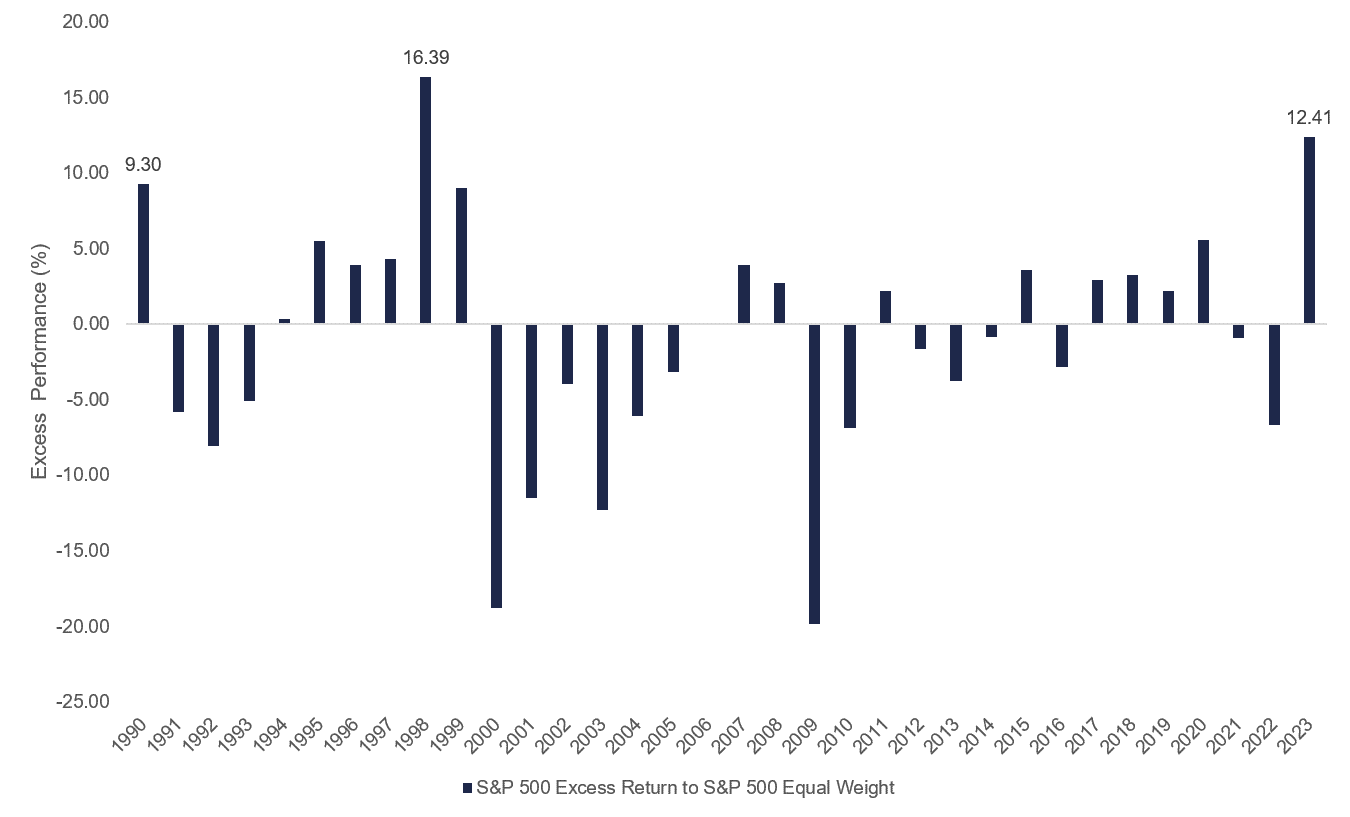

A strong fourth quarter capped a banner year for stocks, especially for a small handful of mega-cap technology stocks. The S&P 500 Index rose 11.7% during the final three months of 2023 and 26.3% for the full year. Despite a late year broadening of the market rally that allowed a number of smaller, more economically-sensitive laggards to participate, the market averages were primarily powered by the so-called “Magnificent Seven” (Alphabet, Amazon, Apple, Meta, Microsoft, NVIDIA, and Tesla) that collectively rose 87% for the year. The average stock, meanwhile, did not perform nearly as well this past year, up just 14% – the widest performance gap since 1998. As the chart below demonstrates, these performance anomalies tend to correct back towards longer-term averages. This could mean greater risk for passive investors in 2024 and an increased opportunity set for active stock pickers – particularly those that emphasize valuation as a risk control – as the market continues to broaden out.

The S&P 500 index is a free-float weighted/capitalization-weighted index. The S&P 500 Equal Weight Index (EWI) is the equal-weight version of the widely-used S&P 500.The index includes the same constituents as the capitalization weighted S&P 500, but each company in the S&P 500 EWI is allocated a fixed weight – or 0.2% of the index total at each quarterly rebalance.

Source for Performance: Callan as of December 31, 2023

The consensus view a year ago was that the Fed was going to drive the economy into a recession in 2023, a view to which we subscribed as well. That clearly didn’t happen. Rather, economic growth proved stronger than expected, with real GDP now expected to have grown between 2.25-2.75% for the year. What we misjudged was the amount of excess household savings left over from the pandemic. The San Francisco Fed initially projected these excess savings would be exhausted by the fall, 2023; however, they now expect these savings to be used up by spring, 2024. Excess savings have enabled consumers to continue spending more freely than would normally be expected in the face of significantly higher interest rates.

Employers, encouraged by consumers’ willingness to keep spending, have continued to hire, which further supports consumption. What causes that virtuous cycle to break – and more importantly when – is impossible to know for sure. What we do know is that historically it has been extremely difficult for the Fed to perfectly time its withdrawal of monetary restraint, which is why its track record of delivering “soft landings” is so poor. More typically, as the economy becomes increasingly fragile from the cumulative toll of the Fed’s tightening actions, an unforeseen exogenous shock or financial crisis emerges that pushes the economy over the edge into recession. There is certainly no guarantee that will happen this time, but investing is an exercise in probabilities, and history is heavily tilted to recession under these circumstances. It remains difficult for us to understand how the economy can absorb the amount of monetary tightening it has – +525 basis points of interest rate hikes along with a $1.3 trillion (and growing) reduction in the Fed’s balance sheet – without a deleterious effect.

Meanwhile, inflation has come down more quickly than was expected. The Consumer Price Index (CPI) likely exited 2023 at just over 3% year-over-year, down from a 2022 peak of close to 9.0%. The Fed’s preferred inflation measure, the core Personal Consumption Expenditure (PCE) deflator, slowed to just under 2% on a six-month annualized basis in November, signaling that the Fed may be close to achieving its objective, assuming of course that rate can be sustained. Due to the better than expected progress on inflation, the Fed is now in a much stronger position to react both more quickly and aggressively in cutting rates to support the economy. This helps explain why the market is now pricing as many as six rate cuts in 2024 versus the FOMC’s Summary of Economic Projections that currently forecasts just three.

Excitement around Generative AI was clearly the biggest theme in the stock market this past year, enlivening investors’ imaginations following the late-2022 launch of ChatGPT, and helping to propel many of the early beneficiaries such as NVIDIA, Microsoft, Alphabet, and Adobe. While we share in the enthusiasm for GenAI, in fact we own all four of these stocks in our large cap and thematic strategies, we are also somewhat guarded heading into the new year knowing that too often investors can overestimate the near-term impact of a breakthrough technology, while also underestimating its potential over the long-term. In 2024, it will be imperative that we begin to see more tangible evidence of companies beginning to monetize their GenAI investments, lest investors be disappointed. Beyond the most obvious “pick and shovel” beneficiary, NVIDIA, we continue to expect the winners will be those companies that have both the resources to invest in the necessary computing capacity and the unique data sets to feed the large language models that will power innovative GenAI applications.

In addition to being a bit guarded about the potential for a near-term GenAI letdown, we also remain guarded in our view on the economy and corporate profits in 2024. While recession may have been averted in 2023, we don’t think it has been avoided. We continue to believe we are late in the economic cycle, and expect the lagged effects of the Fed’s aggressive tightening to result in a mild recession in 2024. The U.S. consumer, the usual engine powering the economy, is facing increasing headwinds, like slowing job and wage gains, the resumption of student loan payments, rapidly rising credit card balances (at higher interest costs), and tightening credit availability. These headwinds will surely become even more impactful once excess savings have been exhausted. Our estimate of real GDP growth in 2024 is +0-1% y/y.

We also expect a further moderation in inflation with CPI falling to +2.0-2.5% y/y by the end of the year. Weaker growth and declining pricing power will likely lead to disappointing corporate revenues and profit margins, which is why we expect S&P 500 EPS to be flat at best with 2023’s estimated $220 per share. This compares to the current 2024 consensus of $245, which we view as overly optimistic.

Economic Outlook

The stock market exited 2023 with a lot of positive momentum and bullish sentiment. While that momentum could continue to take stocks somewhat higher in the near term, the set-up for 2024, especially compared to a year ago, is not a particularly favorable one in our view. Unlike a year ago, when stocks were more reasonably priced, investor sentiment was more cautious, and the consensus outlook was recession, heading into the new year stocks are much more richly valued, sentiment is bordering on euphoria, and the consensus view is soft landing. We further worry about excessive investor complacency in the face of rising geopolitical tensions with two wars raging presently and increasing saber-rattling from China over Taiwan. The 2024 Presidential election cycle may also provide added uncertainty and has historically resulted in heightened market volatility, especially earlier in an election year. Amidst this backdrop, we continue to favor higher-quality, defensive growth stocks in our clients’ portfolios whose more assured earnings growth, paired with more reasonable valuations, can provide better ballast amidst more challenging markets in 2024.