February 24, 2022

Where We Are Today

The S&P 500 is currently in the midst of one of the worst beginnings to a calendar year ever – following the Federal Reserve’s (“the Fed”) pivot towards a tighter monetary policy and recent geopolitical tensions. Red hot inflation data is causing investors to reprice risk after discounting higher interest rates. The end of easy money, in addition to supply chain disruptions, is influencing a rotation out of high multiple speculative growth stocks and pandemic themes. Geopolitical tensions in Ukraine are creating additional uncertainty regarding the inflationary impact of higher commodity prices – leading to concerns of a more aggressive Fed response to combat higher and more persistent inflation readings.

Previously, investors were willing to subsidize short-term losses for future gains in an ultra-low interest rate and liquidity fueled equity market environment. This led to some investors extrapolating future profits and stretching valuations beyond any reasonable earnings power. The presumed end of extraordinary monetary accommodation is forcing investors to re-evaluate the “free pass on risk” era and transition towards more normal levels of market volatility and price discovery. This environment should favor active investment strategies designed to control risk by allocating capital from over-valued securities, sectors, or asset classes towards under-valued securities, sectors, or asset classes – exploiting market inefficiencies to generate alpha.

Utilizing low cost ETFs, the Montag & Caldwell Global Tactical Allocation Model (“GTAM”) implements a hybrid approach of quantitative asset class analysis and modeling coupled with qualitative insights from decades of managed money experience. GTAM provides a total portfolio solution designed to tactically navigate the best combinations of valuation and growth trends, while providing a well-diversified portfolio with less exposure to passive market risk.

How We Got Here

After the global financial crisis, the Fed began its Quantitative Easing program – along with a zero interest rate policy – to create economic stability. The intention of the Fed’s monetary approach was to stimulate consumers to spend more in the real economy as the value of their assets rose (The Wealth Effect). The Fed’s bond buying program not only kept rates low, but volatility as well, and investors responded by avoiding low risk securities, like Treasuries, while favoring riskier, and often overpriced assets – because there was no alternative to increasing wealth. Indeed, the Fed achieved asset price inflation that far outpaced economic output, as can be seen in the chart below titled “S&P 500 Market Cap Relative to GDP”. Traditional inflation measures, however, remained elusive – so monetary policy largely remained intact.

The era of financial asset stability (low volatility environment with a bias towards risk) escalated further towards excessive risk appetites after the Covid pandemic response. Fueled by unprecedented global monetary and fiscal stimulus, some investors overestimated or disregarded the fundamental value of many investments relative to speculative growth stories with lofty expectations.

Active management can be challenging in periods like this. Rising tides lifting all boats leave little differentiation and dispersion among investment options.

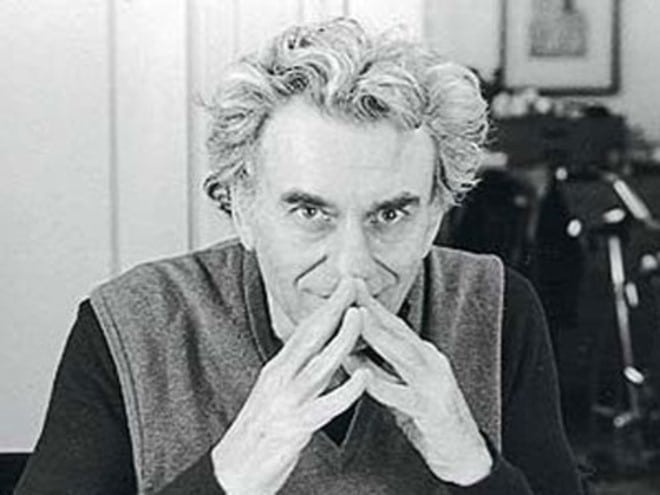

The Minsky Moment

Hyman Minsky, the author of the Minsky Financial Instability Hypothesis, noted that “stability breeds instability, because stability itself is destabilizing” – in that it might induce excessive risk taking behaviors. The Fed manufactured a moral hazard in the markets by allowing investors to believe that they had an insurance policy against loss, which elevated their willingness to take on increasing levels of risk. This resulted in greater levels of market speculation and historically high valuation levels that created the vulnerability to increased bouts of volatility as the market is forced to reprice elevated risk tolerances.

Hyman Minsky, the author of the Minsky Financial Instability Hypothesis, noted that “stability breeds instability, because stability itself is destabilizing” – in that it might induce excessive risk taking behaviors. The Fed manufactured a moral hazard in the markets by allowing investors to believe that they had an insurance policy against loss, which elevated their willingness to take on increasing levels of risk. This resulted in greater levels of market speculation and historically high valuation levels that created the vulnerability to increased bouts of volatility as the market is forced to reprice elevated risk tolerances.

The Catalyst

Quantitative Easing was designed to increase asset prices, therefore Quantitative Tightening will likely pressure asset prices – reversing financial conditions by squeezing liquidity. The normalization process should bring back the traditional market forces and the price discovery needed for a more efficient allocation of capital. This means rewarding winners and punishing losers appropriately. The resulting higher levels of market volatility create greater dispersion among asset classes, which favors tactical allocation strategies such as our global tactical asset allocation model.

Despite this period of heightened market volatility, we remain constructive on the fundamental backdrop. The economy appears to be reaccelerating now that we have emerged from the Omicron soft patch. Inflation continues to run hotter than expected, but is also contributing to robust nominal growth and profits, which are still forecasted to grow over the coming two years. The consumer also remains in great shape. A resumption of historically normal market forces bearing on reasonably priced fundamentals should favor active managers that have a discipline around managing risk with a proven approach towards a favorable allocation of client’s capital.

ABOUT MONTAG & CALDWELL

Montag & Caldwell was founded in 1945 in Atlanta, GA. Our mission is to provide superior investment returns and the highest quality service to our clients. The cornerstone of our success lies in the consistency of our people, process and philosophy. At Montag & Caldwell, we believe that good investment returns are derived from the competent, disciplined, fundamental analysis of individual securities, performed by experienced professionals operating as a team.

We are long-term investors focusing on high quality growth opportunities. Our process is primarily bottom up in which we inter-relate price with earnings momentum. Our strategy uses a present valuation model in which the current price of the stock is related to the risk adjusted present value of our estimate of the company’s future earnings stream.

If you would like to speak with us about how we may be able to serve you, please contact our private client group at [email protected] or call us at (404) 836-7100.